You already know spreadsheets are holding you back. And rightly so—you’re ready to move forward with an AI-powered financial modeling tool.

But with so many options, each claiming to be the best, most transformative, and revolutionary, which one is actually right for you?

You can’t just pick the top-ranking tool on Google and hope for the best. A highly rated tool might not fit your workflow, budget, or integration needs. And the last thing you want is to waste time and money on software that complicates financial modeling instead of simplifying it.

Well, we have done the heavy lifting for you. With this guide, we bring you 7 AI financial modeling software—breaking down their key features, strengths, and pricing so you can make a confident, informed decision.

AI financial modeling software compared

Before getting into detailed analyses of each tool, let’s take a look at them to understand their suitability, impressive features, and base price.

| Tool | Key feature | Best for | Base price |

|---|---|---|---|

| Forecastia | AI-powered revenue & expense stream suggestions | Small businesses, startups with basic finance knowledge | |

| Upmetrics | Builds a comprehensive financial plan | Entrepreneurs & business owners creating business plans | $7 onwards |

| Cube software | Bi-directional spreadsheet integration | Mid-sized companies & finance teams | $2,000 onwards |

| Clockwork AI | Driver based forecasting | Professionals and finance firms | $48 onwards |

| Finmark | 360˚view of key metrics | Startups and growing businesses | $50 onwards |

| Oracle BI | Enterprise-grade financial analytics & reporting | Large corporations with robust analytic needs | $250 onwards |

| Datarails AI | Excel automation & scenario planning | CFOs & finance teams who rely on Excel | $2,000 onwards |

How did I test the best financial modeling software?

I didn’t just rely on websites and Google searches to evaluate these tools. Businesses often make bold claims, craft persuasive messaging, and highlight the best features on their websites. But the real test of any tool lies in actual user experiences.

I analyzed hundreds of reviews on G2, Capterra, TrustPilot, and Product Hunt to get a realistic and unbiased perspective.

My checklist for evaluation was straightforward. I focused on these key questions to shape my detailed review:

- Does the tool provide accurate financial models and forecasts?

- Is the platform intuitive and easy to use?

- How advanced are its AI capabilities?

- Can the software handle large datasets without lag or technical issues?

- Does it seamlessly integrate with essential financial tools?

- Does the pricing justify the value for its target audience?

7 Best AI financial modeling software (tried & tested)

Let's now get into a detailed review of each tool, analyzing where they excel and where they fall short.

1. Forecastia

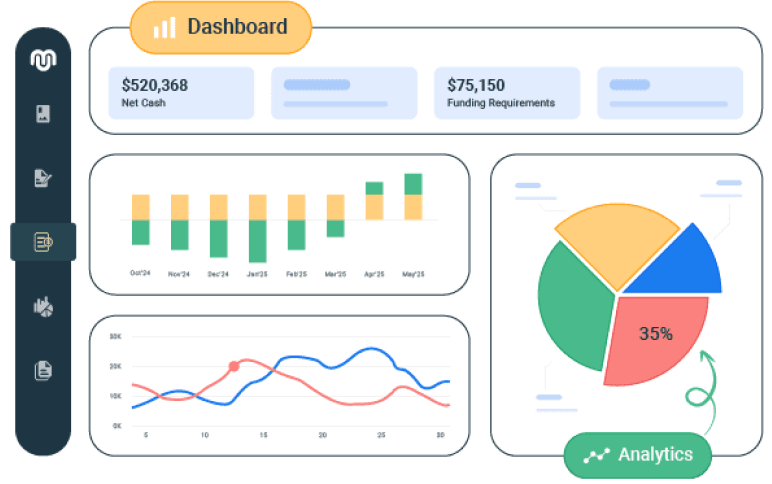

Forecastia is a cloud-based financial forecasting tool that helps businesses project their financial future, whether for the next quarter or a decade.

It consolidates data from your accounting books and automatically generates financial statements—income statements, cash flow statements, and balance sheets—without requiring any complex formulas.

Forecastia comes with inbuilt AI to answer all your financial queries. It also offers AI-powered revenue and expense stream suggestions, ensuring that no cost—big or small—is overlooked when building projections.

Forecastia helps businesses prepare for uncertainties by letting them plan, test, and compare different what-if scenarios. It tracks financial progress by comparing actual performance with forecasts, allowing strategy adjustments as needed.

Overall, Forecastia has a well-guided approach and intuitive interface. Even those with basic accounting and financial planning knowledge can use it to create accurate, investor-ready financial reports.

Key features

- AI-powered forecasting assistant to improve accuracy and identify growth opportunities

- 3-way automated financial modeling

- Scenario modeling to test and optimize different financial scenarios

- Pre-designed financial planning templates specific to your business

- Seamless integration with QuickBooks and Xero

Pricing

The tool is yet to launch. However, you can get early access by signing in.

2. Upmetrics

Upmetrics is a comprehensive business planning app that helps small businesses with end-to-end business, financial, and strategic planning.

Its AI financial assistant automates the development of detailed financial statements, such as cash flow forecasts, income statements, and balance sheets, without requiring complex formulas and calculations.

The tool includes an AI forecasting assistant that provides accurate, detailed suggestions for revenues, expenses, personnel costs, funding needs, and everything in between.

With Upmetrics, you can easily model different financial scenarios and visualize their impacts clearly through striking, interactive dashboards.

Whether you need to build budgets, prepare financial plans, forecast future scenarios, or create executive-level financial reports—Upmetrics covers it all.

If you’re an entrepreneur still in the planning stage or actively seeking funding, Upmetrics’s comprehensive suite of business, strategic, and financial planning features can come in quite handy.

Top Features

- AI forecasting assistant to offer financial suggestions

- Generates detailed three-way financial statements

- Embeds detailed financials into your business plan

- Scenario modeling to test different “what-if” scenarios

- Seamless integration with QuickBooks and Xero

- Interactive dashboards for high-level financial data

- Allows you to collaborate with teams in real-time

Limitations

- Doesn’t offer ERP integrations

- Not suited for large-scale businesses

- AI features are available only on premium and professional plans

Pricing

| Starter | Premium | Professional |

|---|---|---|

| $7/ month | $14/ month | $37/ month |

3. Cube Software

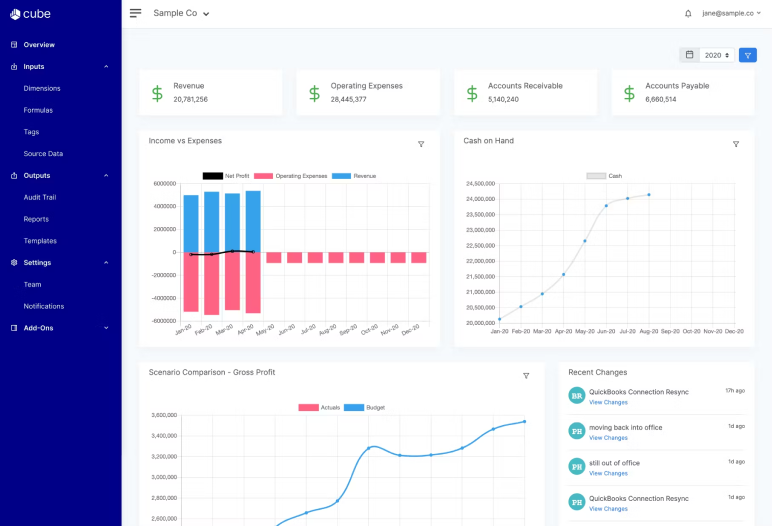

Cube is a financial planning and analysis tool offering bi-directional integration with spreadsheets.

It allows finance teams to automate data consolidation, conduct multi-scenario analysis, and manage reporting without leaving their preferred spreadsheet environment.

Cube’s AI Smart Forecasting develops a fully detailed proposed forecast that can be used to build on your existing plans. It dives into your data and surfaces the top insights about your finances so that you can have every information you need, in record time.

While Cube is a top-rated tool for financial analysis and budgeting, it's extremely pricey for small businesses and emerging entrepreneurs.

Top Features

- Automated data consolidation to integrate data from multiple financial sources

- Multi-currency support to manage financial data across different regions seamlessly

- Centralized formulas and KPIs to ensure consistency across all financial reports

- Multi-scenario analysis for testing various financial outcomes

- Customizable dashboards to visualize financial data clearly and intuitively

- Flags anomalies before analysis so that you can work on clean data

Limitations

- Data ingestion issues between ERP and Cube’s staging database

- Has a steep learning curve

- Lack of flexibility to report in Excel

- Not suitable for small businesses

Pricing

Cube’s pricing is customized depending on the needs of the enterprise. However, it starts at $2,000 a month.

4. Clockwork AI

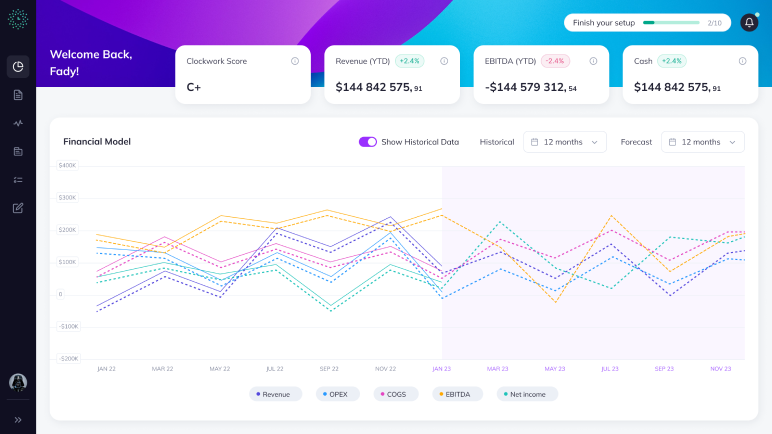

Clockwork AI is FP&A software designed to streamline financial modeling, forecasting, and scenario planning for professionals.

It develops your 3-statement financial models within minutes by directly capturing data from QuickBooks and Xero. The tool uses AI to analyze historical data and transaction history, creating tailored 5-year (monthly) financial projections and 52-week (weekly) cash flow forecasts.

Additionally, you can build headcount plans, conduct driver-based forecasting, and create custom formulas directly within Clockwork. The platform also supports contingency planning by allowing you to test various best-case and worst-case scenarios.

While Clockwork AI is adaptable and feature-rich, it currently lacks built-in visual reports for comparing actual financial performance with forecasts.

Key features

- Up to 5 years of AI-driven financial projections

- Headcount planning for effective workforce financial modeling

- Custom formulas and metrics built directly into your financial models

- Unlimited scenario planning even at the departmental level

- Consolidated forecasting for real-time reporting across multiple accounts

- Integration with major payroll providers

Limitations

- More suited for professionals rather than solopreneurs

- Has a steep learning curve

- More focused on cash-flow forecast

- Need a separate tool to analyze and visualize budget-versus-actual results effectively

- Reported issues with syncing and importing data

Pricing

| Insight | Predict | Ultimate |

|---|---|---|

| $48/ month | $399/ month | $799/ month |

5. Finmark

Finmark, acquired by BILL, is a financial and strategic planning tool for startups and SMBs.

The tool eliminates the need for complex spreadsheets by providing an intuitive platform that automates data entry and analysis. It integrates with tools you already use such as Gusto, Quickbooks, Hubspot, and Wave.

Finmark offers a 360˚view of your finances by helping you track key metrics like runway, burn rate, revenue, expenses, and payroll in real time—all from a single dashboard.

While the tool has earned appraisals for its exceptional UI, some users have reported issues with data import and accuracy.

Key features

- Automated financial modeling to quickly build accurate forecasts without spreadsheets

- Create and compare unlimited scenarios with customized formulas

- Automated hiring plans for effectively modeling personnel costs and headcount needs

- Centralized budgeting to track and control expenses and revenue streams

- Helps compare fundraising scenarios and simplifies due diligence

Limitations

- Users have reported bugs, especially with integrations and data automation

- Building and using formulas is a bit complicated

- Incorrect projections requiring extensive manual checks

Pricing

Custom pricing plans. The basic plan starts at $50 a month for an annual revenue of up to $500,000.

6. Oracle BI

Oracle BI is a business intelligence platform offering a comprehensive suite of performance management applications. It's particularly powerful in financial modeling, helping finance teams build accurate and dynamic models for strategic decision-making.

Oracle allows users to perform detailed scenario analysis, budgeting, forecasting, and profitability modeling for their business. Its advanced analytics tools enable precise modeling of financial outcomes based on historical and real-time business data.

However, Oracle BI only pairs with other Oracle products. Non-Oracle users may find this tool overwhelming and ineffective.

Key features

- Interactive financial dashboards providing real-time insights into KPIs

- Ad-hoc financial reporting that helps generate custom financial analyses

- Integration with Oracle EPM and ERP to streamline data flows and consolidate financial information

- Advanced financial forecasting with precise scenario modeling and predictive analytics

Limitations

- Requires significant training to fully utilize its extensive features

- Tailoring the tool to specific financial workflows can be challenging

- Licensing and implementation expenses can be too much for SMBs

- Integration challenges especially with non-oracle financial systems

Pricing

| Standalone BI applications | BI Applications Fusion edition | Enterprise products |

|---|---|---|

| $250 | $5,800 onwards | $600 onwards |

7. Datarails

Datarails is an FP&A tool designed for CFOs and FP&A analysts who want to keep their Excel financial models intact while automating repetitive processes using AI.

Its AI-powered FP&A Genius functions like a conversational AI. It drills into your real-time datasets and accurately answers questions about financial data, strategy, or performance.

Datarails consolidates all finance integrations and data sources into a single source of truth. Its interactive dashboard reflects real-time data, helping finance teams track KPIs, analyze trends, and make data-driven decisions.

While the tool promises easy adaptability, users have reported its reporting feature to be technical and hard to decipher.

Key features

- Automated data consolidation from multiple finance integrations

- Real-time interactive dashboards for tracking KPIs, revenue trends, and budget variances

- Scenario modeling to test various financial strategies and understand potential outcomes

- Collaboration tools allowing finance teams to work on reports and models together in real-time

Limitations

- Rigid and inconsistent UI

- Difficult to comprehend data mapper

- Limited knowledge base and training material

- Not fit for individuals with basic accounting skills

Pricing

Custom pricing, but multiple reports suggest it starts at $2,000 per month

That’s a round-up of our top 7 AI financial modeling software, each serving a unique and very distinct need.

Why AI financial modeling tools over spreadsheets?

For decades, spreadsheets—especially Excel—have been the go-to tool for financial modeling. Professionals have relied on them to build models, track cash flow, and analyze budgets.

But here’s the thing—Excel is built for professionals who understand accounting and financial modeling. Anyone without that expertise stares at a blank screen, hoping the numbers will somehow make sense.

And, even for experts, spreadsheets are cluttered and error-prone (FYI, 94% of business spreadsheets have critical errors in them). Neither can spreadsheets automate calculations, consolidate real-time data, or run complex scenario analyses.

All of these are things an AI financial modeling software can do—without giving you a headache. AI improves financial modeling by automating consolidation, budgeting, reporting, and everything in between.

Here’s how AI models stand taller than spreadsheets:

- Real-time forecasting instead of static projections: AI models capture data from ERP and accounting systems in real time. This allows businesses to react instantly to financial shifts rather than relying on outdated static models

- Multi-scenario analysis without rebuilding entire models: Test and visualize different financial scenarios instantly, without creating multiple spreadsheet versions

- Error-proof data consolidation: Automatically consolidates financial data, eliminating manual errors, broken formulas, and data inconsistencies

- Seamless collaboration without version chaos: Unlike spreadsheets that create version-control nightmares, AI tools allow role-based access and track every change with audit trails

- Automated model building: No formula errors, no calculative errors. AI tools build entire financial reports without requiring manual setup

Persuaded enough to give your spreadsheets a backseat yet?

The bottom line

With that, you have the best AI financial modeling tools at your disposal.

Now, evaluate your AI needs, consider the integration requirements, and reassess the expertise of your finance team to find the right fit.

If somehow you fall in the category of individuals requiring simple but accurate forecasts without wanting to splurge thousands of dollars every month—Forecastia should be your pick.

Its inbuilt AI, predefined templates, automated processes, and up to 10 years years fo financial projections make financial modeling effortless.

Sign up now and start building your financial models from scratch—without the hassle.

Frequently Asked Questions

What are some of the best AI financial modeling software options available?

Some of the best AI financial modeling software includes:

- Forecastia

- Upmetrics

- Cube

- Finmark

- Clockwork AI

How can I implement AI into my company's financial modeling process?

AI in financial modeling can automate data consolidation, generate future projections, perform scenario analysis, and create interactive dashboards with real-time insights. It streamlines the entire process by reducing manual intervention, automating calculations, and instantly generating reports.

Can I use spreadsheets like Excel or Google Sheets for financial modeling?

Yes, Google Sheets and Excel offer financial functions that allow professionals to build financial models. These sheets are useful for budgeting, forecasting, and data analysis but have limitations that modern AI-powered financial tools overcome.