Imagine running a travel company for 178 years, only to have it crash because you didn’t keep an eye on cash flow. That’s exactly what happened to Thomas Cook in 2019.

People still wanted vacations, so what went wrong? Cash flow—or rather, the lack of it. When suppliers demanded money they didn’t have, the business folded. Just like that.

What we mean to say is profit is nice, but cash is king. If you don't manage cash flow properly, no amount of future sales will save you.

To avoid this fate, businesses need to follow best practices for cash flow forecasting. In this blog, we’ll cover proven strategies to predict, plan, and protect your cash flow.

Let’s improve cash flow forecasting!

1. Automate data collection for accurate forecasting

If spreadsheets worked for cash flow forecasting, you wouldn’t spend 80% of your time compiling reports. But here we are.

Every number has to be manually entered and verified. When the reports are done, another four hours are needed just to trust the numbers.

Automated cash flow forecasting software changes eliminate these inefficiencies by connecting to ERP and banking systems, pulling real-time data, and reducing errors. Reports are faster, giving you more time for strategy.

Using automation instead of spreadsheets helps minimize errors, improve liquidity management, and allow you to focus on high-impact decisions.

2. Use a rolling forecast to stay ahead of market changes

If business conditions changed on a predictable schedule, static forecasts would be enough. But in reality, markets fluctuate constantly. That's why you must create rolling ones to manage cash flow uncertainty and effective decision-making.

A rolling forecast is a financial forecasting method that continuously updates based on actual performance and changing market conditions. It extends beyond the current period—typically by adding a new month or quarter as each one ends.

An FSN Global Survey found that 42% of businesses using a rolling forecast process predict revenue within ±5%, compared to a lower accuracy rate for those relying on static ones.

The difference is clear: Rolling forecasts provide current updates, helping you adjust for sudden revenue dips, delayed payments, or increased expenditures without waiting for the next forecasting period.

“It is important to review and adjust your cash flow regularly. It is not something that you can just check once a month. A rolling 13-week forecasting process will give you continuous insights, which will allow you to make informed decisions for your business units,” says Iqbal Ahmad, founder & CEO of Britannia School of Academics.

More companies are catching on to the use of the rolling forecasts process, a trend that continues to grow as organizations prioritize financial flexibility and real-time cash flow insights.

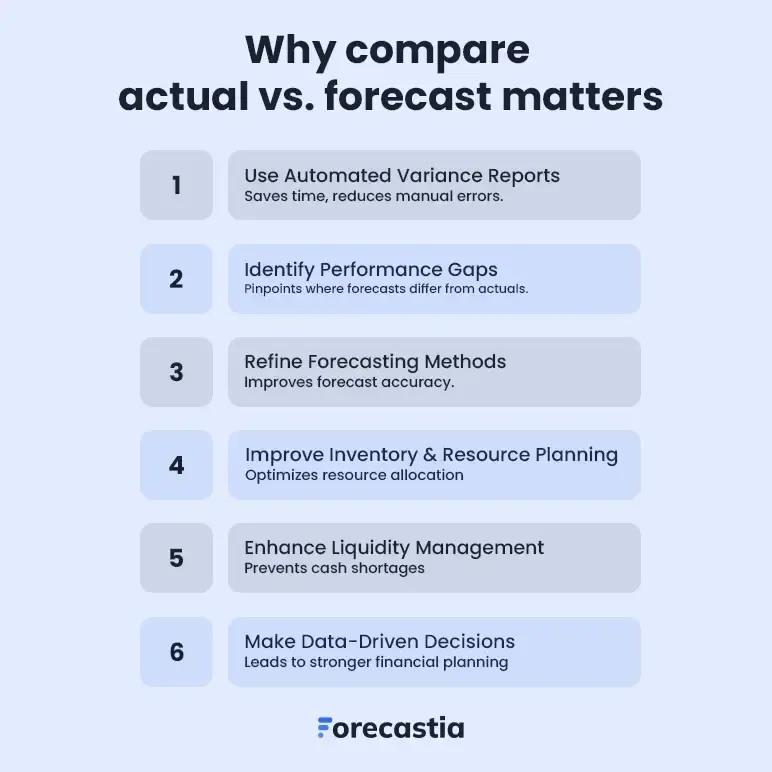

3. Regularly compare actuals vs. forecasts to align with financial realities

A forecast isn’t meant to be a fixed number. It’s a reference point that requires continuous updates

Many rely on automated variance reports (a document that compares actual financial results to projected results and highlights any differences) to track where targets are being met and where adjustments are needed. These reports provide a clear view of performance gaps, allowing them to adjust assumptions and make data-driven decisions.

A study published in the European Accounting Review found that businesses that consistently track forecast variances make stronger financial plans and reduce unexpected risks. The study analyzed how companies refine their forecasting methods by comparing actual vs. projected sales and found that this practice led to three major benefits:

- Better inventory management: Companies that adjusted forecasts based on actual sales data were able to avoid overstocking or stockouts, leading to cost savings and smoother operations.

- Improved resource planning: Businesses that regularly tracked variance reports optimized labor, production, and capital allocation, ensuring they weren’t overspending or underutilizing resources.

- Greater financial stability: Organizations that adjusted forecasts in real-time managed cash flow more effectively, avoided financial shortfalls, and made better investment decisions.

When teams see how their actions affect forecasts, they become more proactive with spending, refine cash forecasting practices, and refine liquidity management.

More accurate forecasting = better decisions and fewer financial surprises

4. Plan for multiple scenarios to handle uncertainty

If 2020 taught us anything, it’s that things can change fast. That’s why scenario planning is a must. It helps companies prepare for different market conditions without the last-minute panic.

A perfect example is Salesforce. The company saw this coming during COVID-19. Instead of waiting to see how things played out, they built multiple financial scenarios to prepare for different economic outcomes. Because of this, they maintained strong liquidity, adjusted strategies, and stayed financially stable while others struggled.

Beyond preparing you during bad days, good cash forecasting also ensures that if business booms, companies are ready to scale.

Companies that implement cash forecasting wisely optimize liquidity, strengthen their cash position and make proactive decisions because uncertainty and preparation beat panic.

5. Balance short-term and mid-term forecasting

Short-term forecasting helps track daily cash flow, identify cash shortages, and make quick adjustments. Businesses that monitor sales quotas, marketing ROI, and profitability gain real-time insights, allowing them to respond to market conditions, pricing fluctuations, and consumer demand shifts with agility.

However, with short-term fixes, you’re plugging a leak without fixing the source. Mid-term forecasting (6 to 18 months) helps analyze financial trends, anticipate risks, and optimize revenue streams, ensuring strong cash management and financial health.

It also allows planning for debt repayments, managing working capital, and allocating resources across different business units over relevant periods.

A balanced approach, using short-term insights for quick decisions and mid-term forecasting for strategic growth, strengthens financial planning, risk management, and overall resilience.

A great example of this is Marriott International's implementation of a "Group Price Optimizer" that combined short-term booking data with mid-term market analysis, increasing revenue by $46 million while enhancing working capital management and sales forecasting.

7. Choose a data-driven cash forecasting process

If your forecasting process takes longer to fix than to analyze, it’s a sign that you’re relying on inefficient methods. Many small businesses still use spreadsheets to track expenses and that leads to missed payments, unplanned disbursements, and inaccurate forecasts.

A more data-driven approach—one that integrates real-time bank transaction data—helps businesses create more accurate projections and provides better financial insights for decision-making.

Automated forecasting eliminates manual errors, reduces time spent on corrections, and allows businesses to focus on cash flow optimization and capital management.

With clean, automated data, businesses can:

- Reduce cash shortages by predicting shortfalls before they happen

- Optimize equity capital by planning financing needs effectively

- Strengthen investor confidence with reliable, real-time financial data.

Moreover, using bank transaction data in forecasting models allows you to make more accurate projections and provide greater value to investors.

FormsPal Co-founder and COO Mike Chappell emphasizes this, stating, "We analyze subscription revenue trends and operational costs regularly to maintain a healthy cash flow. We're also trying to track seasonal fluctuations so that next year, we can be more prepared."

This shows a data-driven cash flow strategy by relying on historical revenue trends, cost analysis, and seasonal tracking to improve financial planning. Instead of guessing, they use real-time and past data to forecast cash flow fluctuations, adjust spending, and prepare for the future with greater accuracy.

These are some of the cash flow forecasting best practices you must follow.

The bottom line

Cash flow issues don’t fix themselves. A good forecast process helps understand gaps, track late payments, and secure funding options before things get tight. Forecastia takes the manual work out of forecasting, making it faster and more accurate.

If you follow best practices, you can stay ahead of cash flow problems and keep your finances under control. One more thing you can do is leverage a good forecasting tool like Forecastia.

It’s an AI-powered financial forecasting software that automates your cash flow planning, tracks actual cash flows, and provides real-time projections so you always know where your finances stand.

Don’t wait for a crisis—start forecasting smarter today.

Frequently Asked Questions

What tools can assist with cash flow forecasting?

For cash flow forecasting, Forecastia automates the process, integrates bank data, and provides real-time insights to track outflows and optimize expenses. Upmetrics can be great for identifying financial trends, streamlining forecasting with automated analysis, and ensuring informed decision-making.

How do I handle unexpected cash flow changes?

To manage unexpected cash flow changes, you should:

- Regularly monitor data,

- Build a contingency fund,

- Explore financial risks early,

- Create and adjust budgets,

- Review customer credit terms,

- Track outflows like bill payments, salary pay, etc.

- Explore spending reductions

How can I make my cash flow forecast more accurate?

Businesses should analyze historical data, incorporate seasonal trends, update forecasts regularly, consider multiple scenarios, use automation for data collection, and monitor key financial metrics. Factoring in external economic shifts ensures the ability to adapt, meet obligations, and maintain confidence among investors.

What are the key components of a cash flow forecast?

The key components of an accurate cash flow forecasting process include:

- Incoming cash: Money received from sales, investments, or other revenue sources.

- Outgoing cash: Payments made for expenses, salaries, debts, and other business costs.

- Net cash flow: The difference between incoming and outgoing cash, showing liquidity status.