What’s the number one reason most businesses fail?

Poor financial planning.

Imagine you launch your business. Sales picked up, and the flow of cash looks steady. Everything moving in the right direction. Then, the market shifts. Costs rise. Demand slows. Competitors move in.

You don’t see it right away. The numbers still look fine on paper…until they don’t. Suddenly, payroll feels tight. Bills pile up—and growth stalls.

This doesn’t happen overnight. It builds up slowly, month after month until there’s no more cash flow to keep the business running.

Financial forecasting helps you avoid exactly that. It’s about using data and financial statements to predict what’s coming and preparing for it before it happens.

This blog explains financial forecasting, why it really matters, how it differs from other financial terms, and the most effective methods.

Let’s begin!

What is financial forecasting?

Financial forecasting is predicting a company’s financial outlook based on historical numbers like sales, costs, flow of cash, and pro forma financial statements. Though it uses financial data, it also relies on assumptions, which can shift as conditions change.

For example, a retail store might expect higher sales during the holidays and prepare by planning production cycles and increasing inventory. However, a startup might conduct financial forecasting to figure out when it will break even and how much funding it will need to get there.

Financial forecasting gives businesses the ability to plan with confidence, predict revenues, avoid surprises, and make financial decisions backed by actual financial data.

What is the importance of financial forecasting for any business?

Forecasting connects the dots between where your business is now and where it needs to be.

Here’s how forecasting serves your business decisions:

Sets the foundation for budgeting

Financial forecasting lays the groundwork for the budgeting process. It leverages historical data to project future financial outcomes, offering businesses a clear understanding of their potential revenue and expense patterns. With these projections, companies can set budgetary targets that are realistic and grounded in data, ensuring better resource management.

Builds financial discipline with planning

Forecasting creates accountability by setting measurable goals and benchmarks. It provides a framework to track progress, manage spending, and maintain financial stability over time. Clear targets make it easier to evaluate performance using tools like income statements and make adjustments when needed.

Helps with data-driven decisions

Whether you’re launching a product, expanding to new markets, or cutting costs, financial forecasting helps you stay focused and realistic. As W. Edwards Deming said, “Without data, you’re just another person with an opinion.” Cash flow forecasting and financial modeling give your decision structure by analyzing market trends.

Strengthens risk management

While a financial risk can’t be eliminated entirely, planning for different scenarios reduces uncertainty and helps you recover from setbacks. Cash flow financial forecasting helps evaluate and manage risks. It identifies potential challenges and prepares contingency plans for unexpected events by analyzing income statements and pro forma projections.

Fuels consistent growth

Financial forecasting supports planned and consistent growth. It involves using financial data and assumptions to identify opportunities to cut costs and increase revenue. With better insights, businesses can optimize spending and focus resources on growth-driven strategies. Pro forma reports and financial modeling also support growth strategies by evaluating expansion scenarios and investment returns.

You’d think the forecasting definition would be easy. Although it’ is not so complicated, people often get tangled up with other terms like budgeting, planning, and modeling. So, let’s compare.

Key differences: financial forecasting vs budgeting vs planning vs modeling

Since all these processes deal with numbers and projections, they may appear to serve the same function, i.e. financial management, when in reality, they address different aspects of it.

Here’s a table to explain it all:

| Aspect | Financial forecasting | Budgeting | Planning | Modeling |

|---|---|---|---|---|

| Definition | Financial forecasting predicts a company’s future performance using past data, financial statements, cash flow statements, trends, and market conditions. | Budgeting is the process of creating a detailed financial plan that outlines expected income and future expenses over a specific projected fiscal period, usually one fiscal year. | Financial planning is a long-term strategy for managing finances, covering growth, debt management, investments, and risk mitigation. | Financial modeling involves creating detailed mathematical representations of a business’s financial performance to test strategies and evaluate projected financial conditions. |

| Purpose | Helps estimate future outcomes based on past data and trends. | Helps set financial targets and allocate resources for cost control. | Helps develop a long-term roadmap for growth, investments, and risks. | Helps simulate scenarios and test strategies to analyze outcomes. |

| Focus | Predicts revenue, future expenses, and flow of cash for short-term planning. | Provides a framework for managing income and expenses. | Focuses on broader financial goals like expansion and debt reduction. | Builds models to evaluate risks, returns, and business performance. |

| Application | Guides financial decisions and short-term adjustments. | Manages day-to-day spending and aligns budgets with goals. | Supports strategic planning and sets long-term objectives. | Evaluates the impact of different strategies before implementation. |

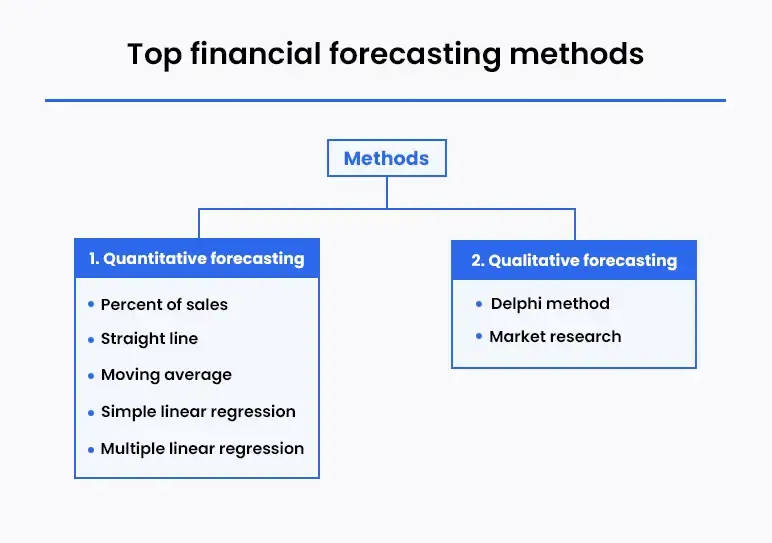

Top financial forecasting methods

Each forecasting method highlights different areas of your business, whether it’s projecting sales or planning budgets. Selecting the right approach ensures your forecasts align with your goals and support better decision-making.

When it comes to financial forecasting, businesses typically use one of two approaches: quantitative or qualitative forecasting.

1. Quantitative forecasting

Quantitative financial forecasting analyzes historical data like sales, website traffic, and budgets to predict financial performance. It applies structured models to provide accurate revenue projections, monitor consumer behavior, find new trends, and pave the way for strategic business planning.

Here are some quantitative methods:

- Percent of sales: Calculates future financial outcomes as a percentage of sales, assuming trends like costs increase proportionally with sales.

- Straight line: Assumes a company’s historical growth rate will stay constant and applies it to forecast revenue.

- Moving average: Uses averages or weighted averages of previous periods to predict short-term trends, ideal for sales forecasting and revenue forecasts.

- Simple linear regression: Forecasts based on the relationship between independent and dependent variables through a linear relationship.

- Multiple linear regression: Analyzes relationships between multiple dependent and independent variables to create accurate forecasts.

2. Qualitative forecasting

This is a knowledge- based forecasting method that focuses on expert opinions and pro forma statements rather than historical data, making it ideal for businesses launching new products or entering unfamiliar markets. Tools like surveys and focus groups assess customer preferences without prior performance data.

Two popular methods are:

- Delphi method: Gathers expert opinions through surveys to predict performance, refining insights until a shared agreement is reached.

- Market research: Focuses on gathering insights into demographic trends and consumer behavior, helping businesses evaluate demand and attract investors.

How to Choose the Right Forecasting Method?

There isn’t a one-size-fits-all method. The best forecasting approach depends on what you need to predict and how far ahead you’re planning.

Here’s a breakdown of which method is suitable when:

- Percent of sales is ideal for short-term budget planning and predicting how expenses like inventory and salaries will scale with sales growth.

- Straight-line forecasting works well for businesses with consistent performance, offering a baseline projection for sales or expenses.

- Moving average is perfect for businesses with seasonal variations or fluctuating demand.

- Simple linear regression is ideal for businesses looking to track specific trends or performance drivers.

- Multiple linear regression is suitable for businesses needing detailed predictions influenced by several factors, such as pricing, marketing, and competition.

- Delphi method is perfect for startups or businesses entering untested markets.

If choosing the right method feels overwhelming, consider using AI-powered forecasting tools. These tools analyze your data, identify patterns, and recommend the best approach, removing guesswork and saving time. You can also integrate the annual budget process and track performance in changing fiscal environments.

How to prepare financial forecasts for your business?

Much like weather forecasts, financial projections help you prepare for sunny days and storms ahead. But how do you create projections you can trust?

Here’s the financial forecasting process that will provide the clarity and confidence you need.

1. Understand your business goals

Before diving into numbers, start with one question: what do you want to achieve? Your realistic business goals shape your financial decisions and determine what resources you will need to make them happen.

Let’s say your goal is to generate $300,000 during your first year of opening a coffee shop. To reach that target, you will need to:

- Estimate sales volume: How many cups of coffee or pastries do you need to sell each day to hit that number?

- Calculate expenses: Factor in rent, ingredients, equipment, salaries, and marketing costs.

- Evaluate immediate funding needs: Will your future income cover operating expenses, or do you need a loan?

You might also look at equipment costs. Should you buy or lease machines? And what about marketing? Do you need a bigger push to attract foot traffic early on? That will affect forecasts and your ability to predict future revenues.

Everything starts with your goal. Once the management teams define it, the method used for forecasting gives the tools to work backwards, breaking it into sales targets, expense plans, and cash flow projections that guide your decision-making.

The clearer your goal, the smarter your roadmap.

2. Keep all existing data handy

Before you can predict future revenues, you need to know where your business has been.

If you’re opening a coffee shop, start by gathering key financial details:

| Revenue | How much do you expect to earn from coffee, pastries, and merchandise? |

| Losses | Were there any shortfalls during test runs, like discounts or giveaways? |

| Liabilities | Do you have loans to cover equipment or renovations? |

| Investments | How much have you put into startup costs? |

| Equity | What’s your ownership value after accounting for debts? |

| Expenditures | Track costs for rent, salaries, supplies, and marketing. |

| Fixed Costs | Recurring expenses - utilities, internet, and insurance |

Apart from that, you also need to keep all the financial statements, including income statements, balance sheets, and cash flow statements, to analyze past performance. Reviewing these documents is a critical step in financial accounting to evaluate profitability and track expenses effectively.

This data forms a baseline for future projections and evaluating business performance.

3. Choose a time frame for your forecast

Choosing the right time frame for your financial forecast depends on your goals and the stage of your business.

Most businesses create multi-year projections, with 3 years being the standard. Investors and banks often require at least 3-year forecasts to assess growth potential before lending money or investing.

How to choose the right forecasting time frame?

- Short-term forecasts (up to 1 year): Focus on immediate expenses, sales, and flow of cash, useful for tracking daily, weekly, and monthly performance.

- Medium-term forecasts (1–2 Years): Plan for scaling operations, expanding teams, or adding new product lines, helpful for businesses preparing for seasonal trends or short-term market shifts.

- Long-Term Forecasts (3 Years or More): Provide investors and lenders with a roadmap for growth and profitability, focusing on broader strategies.

Continuing with the coffee shop,

- First 3 months: Forecast daily and weekly sales based on foot traffic, customer behavior, and local events. Calculate costs like rent, wages, inventory, and marketing.

- 6 months: Plan seasonal drinks, holiday promotions, or new menu items. Adjust forecasts based on early performance.

- 1 Year: Test larger decisions like adding seating, hiring more staff, or expanding hours.

- 3 Years: Create a long-term growth plan for opening additional locations or offering catering.

4. Choose a financial forecast method

Choosing the right financial forecasting model depends on your business data, goals, and complexity. Start by asking:

- What data is available? Established businesses can use quantitative models, while new ventures may rely on qualitative methods.

- What’s your goal? Are you forecasting revenue, planning budgets, or identifying trends? Different goals require different methods.

- What factors impact your forecast? Consider market trends, seasonal patterns, and customer behavior.

Here’s a quick table showing which method to go for depending on common goals:

| Percent of sales | Quick budget estimates tied to revenue growth. |

| Straight line forecasting | Simple projections based on steady growth trends. |

| Moving average | Tracking short-term fluctuations and seasonal patterns. |

| Simple linear regression | Predicting outcomes based on relationships between two variables. |

| Multiple linear regression | Analyzing several factors for detailed forecasts. |

| Delphi method | Using expert opinions without existing data. |

| Market-based research | Gaining insights on trends and customer preferences. |

Continuing with the coffee shop example, you can use quantitative forecasting if you’ve already tested the waters with a pop-up stand. Look at past historical data, seasonal trends, and peak hours to identify trends and predict future income and future costs. Did sales spike during morning commutes? Were weekends slower? These patterns help estimate performance.

But what if this is your first coffee shop and you don’t have past financial statements? Then qualitative forecasting might be the way to go. You’d rely on statistical data and insights from nearby cafés to set expectations. You might even survey locals to gauge demand for specialty drinks.

5. Choose your forecasting tool

Building multi-year projections and keeping them updated takes time. Doing it manually doesn’t make sense. You need a tool that automates the forecasting process and keeps things accurate.

Here’s what to look for when choosing a forecasting tool:

- Ease of use: Pick a tool that’s simple to learn and navigate.

- AI features: Look for AI capabilities that handle calculations and improve accuracy.

- Integrations: It should connect easily with accounting software like QuickBooks or Xero to sync with your balance sheet and other financial statements.

- Scenario analysis: Allows you to test different outcomes and plan for risks.

- Real-time data: Syncs with live financial data to keep forecasts accurate.

- Reports and visuals: Generates clear charts and reports to explain the numbers, including balance sheet summaries for deeper insights

- Scalability: Can manage more data and complexity as your business grows.

- Cost: Make sure it fits your budget without cutting the features you need.

Decide which features matter most and choose a tool that makes forecasting simpler, faster, and more accurate.

6. Forecast expense and sales

Accurately forecasting both expenses and sales volume is essential for managing flow of cash, optimizing resources, and planning for growth.

List every expense required to operate your business, including:

- Cost of Goods Sold (COGS): Costs directly tied to production.

- Operational Expenses: Rent, salaries, utilities, and supplies.

- Marketing Costs: Advertising, promotions, and branding efforts.

- Administrative and Financial Costs: Software, legal fees, loans, and taxes.

For new businesses, focus on startup costs - divide them into one-time expenses (licenses, equipment) and recurring expenses (rent, payroll).

For established businesses, expenses can be organized by departments or product lines to make tracking more detailed.

An accurate sales forecast ensures you can manage the flow of cash and align spending with growth goals. Use the following to guide projections:

- Earlier data: Past sales trends and performance.

- Market situation: Consumer demand and competitor analysis for startups without existing data.

- Benchmarks and trends: Industry standards and current economic conditions.

Remember that sales are influenced by seasonal changes, economic fluctuations, and consumer trends. Adjust forecasts regularly to keep them accurate and relevant. Link sales forecasts to expenses to ensure the business has the resources needed to meet demand without overspending.

7. Build a visual report

Numbers alone aren't enough. You need to present them in a way that all your readers can quickly grasp and use to provide valuable insight.

Let’s go back to your coffee shop. Suppose your forecast shows sales peaking during the morning rush but dipping in the afternoons. You plan to add pastries and offer discounts to boost afternoon traffic.

Now, how do you present this?

Use visual reports constituting colorful charts, graphs, and dashboards that highlight trends and projections. Show how your plan boosts revenue and covers costs without burying people in numbers.

Whether you pitch to lenders or rally your staff, how you present your forecast is just as important as the numbers inside it.

8. Track, update, and analyze

Financial forecasts aren’t always 100% accurate. Sudden changes, like unexpected expenses or demand spikes, can throw off projections if they’re not updated regularly.

How to track and update forecasts?

- Use real-time data to monitor sales and expenses daily.

- Identify patterns - are changes seasonal, driven by competitors, or tied to economic shifts?

- Update forecasts frequently to reflect new data and avoid surprises.

If you forecasted 200 coffee sales a day, but a local event suddenly drives that number to 300. Without updated forecasts, you may struggle with staffing and inventory.

What happens if your sales suddenly spike or crash? Can your forecasting process keep up?

But this data alone isn’t enough. Analyze the forecasting process. Are the trends seasonal? Is a competitor affecting sales? Look at internal performance, but don’t ignore relevant economic conditions like market conditions or business cycles. The right tools and sharp analysis turn financial forecasts into decision making power.

Preparing Financial Forecasts Using AI

Here’s something to think about - 94% of spreadsheets have mistakes. And in businesses where decisions hinge on data, errors like these aren’t just inconvenient. They are expensive!

Manual forecasting is also time-consuming. Updating data, fixing formulas, and running calculations take hours. Worse, it struggles to keep up with real-time changes like sales fluctuations or unexpected expenses.

AI is transforming the forecasting process. Instead of depending on static spreadsheets, businesses are adopting AI-powered tools that:

- Analyze data faster and more accurately.

- Learn patterns from historical trends to improve predictions.

- Adapt forecasts instantly based on real-time updates.

Forecastia AI is an AI-powered financial forecasting software built specifically for businesses that need detailed projections without the extras you don’t use.

Plan smarter and grow faster with accurate financial forecasting

What’s holding your forecasts back? Is it the age-old spreadsheet or the time taking process? AI-powered tools are rewriting the usual norms and making forecasting faster, smarter, and more accurate. It cuts through manual work, analyzes trends in seconds, and even flags risks before they turn into problems.

The future of financial forecasting is here. Are you ready to make the switch?

Frequently Asked Questions

What are the most common methods used in financial forecasting?

Most small business owners use straight-line forecasting when running their numbers. This simple forecasting model is one of the easiest to build and can be used by anyone

How can small businesses benefit from financial forecasting?

Financial forecasting is a vital tool that allows small businesses to predict revenues, expenses, and capital needs. This is based on past data, market trends, and projected company growth.

What are the key components of a financial forecast?

The key components of financial forecasting include:

- Revenue forecast

- Expense forecast

- Cash flow forecast

- Profit and loss (P&L) statement

- Balance sheet forecast

- Break-even analysis

- Scenario analysis

How often should businesses perform financial forecasting?

Monthly or quarterly updates work well for most companies. Major events such as product launches, funding rounds, or economic shifts should also trigger a forecast update to keep projections accurate and actionable.

What is the difference between qualitative and quantitative financial forecasting?

Qualitative forecasting uses non-measurable information, such as expert opinions, market research, and industry trends. Quantitative forecasting, on the other hand, depends on measurable historical data and statistical models.

What are some common mistakes to avoid in financial forecasting?

- Inadequate financial planning

- Lack of strategic planning

- Overlooking external influences

- Disregarding historical data

- Ignoring investment opportunities

- Failure to create a budget

- Poor communication practices

- Absence of an emergency fund

- Ineffective debt management

How can financial forecasting improve investment decisions?

Accurate financial forecasting supports stronger financial outcomes, ensures more stable cash flow, as well as improves access to credit and investments needed for business growth.