Did you know that nearly 60% of new restaurants fail in their first year, and almost 80% shut down within five years?

Rising costs, fierce competition, and cash flow issues are often the reason. But so is financial planning (or the lack of it).

So, creating a solid restaurant financial plan is the best way to avoid this fate. It helps you manage costs, predict revenue, and stay prepared for the unexpected.

But how to prepare one?

Worry not! This guide will walk you through how to create a financial plan that helps your restaurant thrive.

Let’s begin!

How do you build restaurant financial projections?

Creating realistic financial projections for your restaurant involves thorough analysis and meticulous planning to comprehend its financial health and growth potential.

Here’s a step-by-step guide to help you build accurate and actionable projections while ensuring you factor in every detail:

1. Gather essential information

First, collect all the relevant key data that lays the groundwork for accurate financial projections.

This would include restaurant details like:

- Current operations

- Target demographics

- Historical financial performance

- And industry benchmarks.

Start with your sales data—look at daily and weekly revenue trends, peak sales times, and how they change with seasons. For new restaurants, analyze the latest market trends, industry benchmarks, and local competitors to make educated estimates.

Further, understand your customers inside out.

- Who are they?

- What do they like?

- What are their dining styles?

Then, track inventory data—monitor stock levels, turnover rates, and supplier costs to ensure precise cost calculations.

Most importantly, don’t forget to analyze the past performance data of your restaurant to understand what drives your business.

Consider analyzing previous revenues, costs, and profits to detect trends and highlight the areas for improvement. Analyze how some of the marketing campaigns, menu items, or seasonal changes impacted your sales and cost.

That’s how you'll have everything you need to create accurate and actionable financial projections.

2. Make rough pre-assumptions

Now, make some preliminary assumptions for your restaurant’s financial projections based on gathered data. Such estimates will outline your business's revenues, expenses, and profitability levels.

Start by focusing on the basics: How much you’ll make in monthly sales, how much customers will spend on average, and what your operating costs might look like.

Use the understanding of past sales trends, industry benchmarks, and your own research. Even, take into account factors like seasonal changes or upcoming menu additions that could affect your numbers.

Here are a few key metrics to consider while making your assumptions:

- Revenue growth: Predict a percentage increase in sales, such as a 5% annual growth based on an expanding customer base or marketing efforts.

- Cost increases: Assume potential rises in ingredient prices or wage adjustments, such as a 10% increase in utilities during summer.

- Seasonality: Factor in holiday sales spikes or slow months like January for post-holiday dining.

- Economic conditions: Account for inflation, rising wages, or other economic factors that may impact both costs and customer spending power.

Don’t aim for perfection—these are rough estimates to guide your planning that will evolve over time. So revisit them periodically as actual data comes in.

3. Make revenue projections

Revenue projections are all about figuring out how much money your restaurant might make.

To get started, think about a few simple things: How many seats you have, how often customers turn over, and how much they usually spend.

Breaking it down step-by-step makes it easier to see your earning potential.

If you’ve got 50 seats, serve two meal periods a day, and customers spend around $30 each, here’s the math:

50 seats × 2 meals × $30 × 30 days = $90,000/month

But, you’ll also need to consider things like holidays, weekends, or special events—they can bring in more people and boost your revenue even further. On the other hand, slower months or weekdays might drive less income.

Additionally, account for other ways to make money. Services like catering, delivery, private dining, or hosting events can add a big percentage to your overall revenue.

By including these extra streams, you’ll get a more accurate picture of what your restaurant can earn.

Revenue projections aren’t merely a dry exercise of crunching numbers—they set realistic expectations while preparing for both the busy times and the quieter ones.

4. Calculate the Cost of Goods Sold (COGS)

The next step is to calculate your Cost of Goods Sold (COGS)—basically, the direct costs of making the food and drinks you sell. For this, it would include your ingredients, drinks, and other items that directly go into your recipes.

Here's an easy way to do your COGS calculation:

List the ingredients: Write down everything you use to make your dishes, from food and drinks to garnishes.

Find the costs: Scan invoices or receipts from suppliers for the price of each ingredient.

Calculate per dish: Calculate how much it costs each time to create a dish (i.e. if a pasta plate costs $5 to make and you're selling 300 plates, your COGS for that dish becomes $1,500).

Add it up: Total the cost for all menu items to get your monthly COGS.

For example, if your restaurant spends $20,000 a month on ingredients and beverages to generate $90,000 in revenue, your COGS is $20,000.

Knowing your COGS will help you keep costs under control, reduce waste, and boost profits.

5. Estimate operating costs

Next, describe the expected expenses incurred to operate your restaurant.

When assessing the business operational costs, first list the fixed costs that would remain the same month in and out, including rent, insurance, and salaries.

Then, you have to identify variable costs that vary over time. It includes utilities, supplies, or marketing expenses.

Lastly, sum up the fixed and variable costs to come up with your total operating costs.

Overall, by calculating your operating costs, you can manage your budget and know whether your revenues can cover all the expenses to leave room for profit.

6. Prepare financial statements

After estimating your restaurant's revenue, COGS, and operating expenses, it’s time to draft clear financial statements. These documents are essential for illustrating your restaurant’s financial health and growth potential to prospective investors.

Here are the critical financial statements and reports that you should consider including in your plan:

- Income statement (profit and loss statement)

- Cash flow statement

- Balance sheet

- Break-even analysis

By adding these financial statements, you showcase your financial standing to potential investors so they can make well-informed decisions regarding investment.

We'll explore each of these financial components in greater detail in the upcoming sections, giving you insights needed to create a strong financial plan.

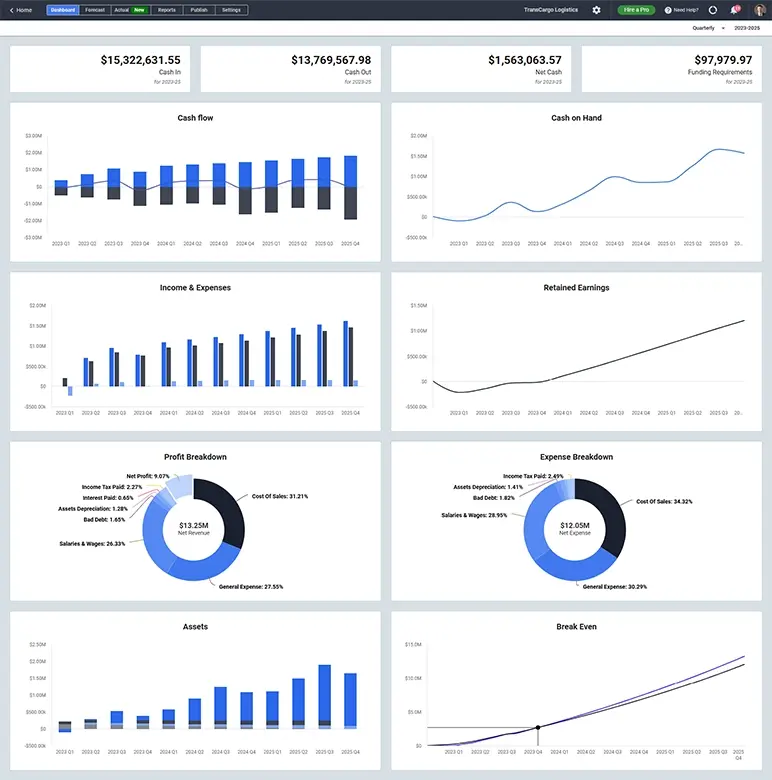

7. Prepare visual reports

Numbers alone aren't enough. Present your restaurant’s financial data in a visually appealing and easily digestible format that readers can quickly understand and get valuable insights.

Using charts and graphs makes it easier to highlight your restaurant’s key aspects, including revenue trends, expenses, profit margins, and cash flow.

Don’t worry; it’s easy. Use simple bar charts, pie charts, and line graphs to make the data clear. Also, highlight patterns like seasonal sales changes or rising costs to help with planning.

This will not only help analyze financial data but also enable you to communicate key metrics effectively to your team as well as investors.

8. Test assumptions, consider scenario analysis

Finally, take a step back and test the numbers to ensure your projections are more accurate. Try to run different scenarios (best- and worst-case) to see how changes impact your financial outcomes.

For instance, analyze what happens if ingredient costs increase by 15% or customer traffic drops during slower months.

Considering these “what-if” situations helps you identify potential problems in business operations and come up with solutions in advance. It even increases transparency and lets investors better understand your restaurant’s future with different scenarios.

Overall, these test assumptions and sensitivity analysis will help you make strategic decisions and necessary adjustments to keep your restaurant running smoothly.

Key financial statements of a restaurant financial plan

A detailed restaurant financial plan typically includes important financial documents like the income statement, cash flow statement, balance sheet, and break-even analysis.

These reports clearly describe your restaurant's current monetary position and the overall financial strategy to achieve future goals.

Let's explore each statement in detail.

1. Income statement

The income statement is also known as the profit and loss statement. It gives you a solid understanding of your restaurant’s revenue, expenses, gross margin, and net profit for a specific time.

It helps you see whether your business is making enough money to cover its costs and turn a profit.

The gross profit is what you get after subtracting the COGS from the total revenue. This shows how efficiently your restaurant uses its resources.

Further, divide the gross profit by revenue and convert it into a percentage to determine the gross margin.

Then, reduce operating costs like rent, salary, and utility to get the EBITDA. Finally, subtract interest, taxes, depreciation, and amortization from the EBITDA to arrive at the net profit of your restaurant—the figure that investors care about the most.

Here’s an example of a mid-sized Italian bistro’s income statement to demonstrate these calculations:

| Category | Amount ($) |

|---|---|

| Revenue | |

| - Dine-In Sales | 70,000 |

| - Takeout and Delivery | 20,000 |

| - Beverage Sales | 10,000 |

| Total Revenue | 100,000 |

| Cost of Goods Sold (COGS) | |

| - Ingredients | 28,000 |

| - Packaging Materials | 2,000 |

| Total COGS | 30,000 |

| Gross Profit | 70,000 |

| Operating Expenses | |

| - Rent | 12,000 |

| - Utilities | 3,500 |

| - Wages and Salaries | |

| --- Kitchen Staff | 15,000 |

| --- Front of House Staff | 12,000 |

| - Management Salaries | 8,000 |

| - Marketing and Advertising | 2,000 |

| - Maintenance and Repairs | 1,500 |

| - Insurance and Permits | 1,000 |

| - Miscellaneous Expenses | 4,500 |

| Total Operating Expenses | 55,000 |

| EBITDA | 15,000 |

| Interest, Taxes, and Depreciation | |

| - Interest Payments | 2,000 |

| - Taxes | 1,500 |

| - Depreciation | 5,000 |

| Total Adjustments | 5,000 |

| Net Profit | 10,000 |

An Italian bistro makes $1,00,000 in revenue each month, including $70,000 from dine-in sales, $20,000 from takeout and delivery, and $10,000 from beverages.

Each month, it incurs $30,000 in food costs (COGS) and spends $55,000 on operating expenses. After covering these, the bistro is left with an EBITDA of $15,000.

Once $5,000 goes toward interest, taxes, and depreciation, the bistro ends up with a net profit of $10,000, showing a positive profit margin.

If food or operating costs rise in the future, this income statement will help pinpoint where adjustments or cost-cutting might be needed to keep things on track.

In simple terms, the income statement tells you if your restaurant is making money and staying financially healthy over time.

2. Cash flow statement

A cash flow statement shows how money is coming in and going out of your restaurant over a certain period. It helps you figure out if you have enough cash to cover your daily expenses.

It’s also great for spotting potential cash shortages, especially during slower months, and demonstrates how much cash is coming from operations compared to things like investments or loans.

To create one, you’ll need to include cash from sales, costs like food and supplies, and other overhead expenses. It highlights how much money your restaurant is making and spending during that period.

| Category | Amount ($) |

|---|---|

| Cash Inflows | |

| - Customer Payments | 90,000 |

| - Catering Income | 10,000 |

| Total Cash Inflows | 100,000 |

| Cash Outflows | |

| - Ingredient Purchases | 25,000 |

| - Rent | 12,000 |

| - Utilities | 3,500 |

| - Wages and Salaries | |

| -- Kitchen Staff Salaries | 15,000 |

| -- Front of House Salaries | 12,000 |

| -- Management Salaries | 8,000 |

| - Loan Repayment | 5,000 |

| - Marketing and Advertising | 2,000 |

| - Repairs and Maintenance | 1,500 |

| - Insurance and Permits | 1,000 |

| - Miscellaneous Expenses | 2,500 |

| Total Cash Outflows | 80,500 |

| Net Cash Flow | 19,500 |

That said, it’s a good illustration of how well your business is at generating cash. The precision of your projections in these aspects directly impacts the reliability of your cash flow.

So, be realistic with the assumptions you make in the cash flow statement. Use industry standards and consider market situations to ensure accuracy.

3. Balance sheet

A balance sheet gives a quick snapshot of your restaurant’s financial position for a specific timeframe. It shows what the restaurant owns, what it owes to others, and what’s left for you.

After all, it covers these key elements:

- Assets: Cash at hand, accounts receivable and property, equipment.

- Liabilities: Financial obligations like short-term debts and long-term loans.

- Equity: The leftover earnings once liabilities are subtracted from assets.

Ideally, it’s presented as, Assets = Liabilities + Equity.

| Category | Amount ($) |

|---|---|

| Assets | |

| - Cash | 30,000 |

| - Accounts Receivable | 5,000 |

| - Inventory | 10,000 |

| - Equipment | |

| -- Kitchen Equipment | 35,000 |

| -- Dining Area Furniture | 15,000 |

| - Leasehold Improvements | |

| -- Flooring and Paint | 8,000 |

| -- Electrical and Plumbing | 12,000 |

| Total Assets | 115,000 |

| Liabilities | |

| - Accounts Payable | 8,000 |

| - Short-Term Loans | 10,000 |

| - Long-Term Debt | 40,000 |

| Total Liabilities | 58,000 |

| Owner's Equity | |

| - Initial Investment | 50,000 |

| - Retained Earnings | 7,000 |

| Total Owner's Equity | 57,000 |

| Total Liabilities and Equity | 115,000 |

Investors really pay close attention to the balance sheet because it shows them your restaurant’s financial structure, return on investment (ROI), and overall stability.

It also provides an idea of the cash that is available to you, how the money is blocked, and what kind of solid business you are running.

4. Break-even analysis

We all know that profit is the all-time motive of all restaurant owners. The real question is: When does the money actually start coming in?

A break-even analysis fits the bill at this stage. It shows exactly how many units you’ll need to sell for all the costs to be recovered-no profit and no loss; just a breakeven.

Let's take an example to see how it works.

For a quick-service restaurant:

Fixed costs: $15,000 (including rent: $8,000, utilities: $2,000, and wages: $5,000)

Variable costs: $25,000 (ingredients, packaging)

Revenue: $80,000

Contribution Margin: ($80,000 - $25,000) ÷ $80,000 = 0.6875 (or 68.75%)

Break-even sales calculation: $15,000 ÷ 0.6875 = $21,818

So, this restaurant needs to bring in at least $21,818 a month to cover all its costs and break even.

This analysis shows exactly how much revenue is needed to reach the point where your total sales just cover your costs, with no profit or loss.

In addition, this will give potential investors or lenders a fair idea of when your restaurant would be profitable.

Download free restaurant financial projections example

Creating a restaurant financial plan from scratch seems overwhelming. After all, Excel sheets are tiring and endlessly long. But no worries! We’re here to help you with our free restaurant financial plan sample.

It covers all the key components of a restaurant's financial projection, such as sales forecast, P&L or income statement, balance sheet, cash flows, and break-even analysis, simplifying the entire financial planning process to help you get started.

Build accurate financial projections using Forecastia

That’s it! We’ve discussed almost everything about creating restaurant financial projections in this guide. Now, it should be much easier for you to put that knowledge into action and start planning.

But if it still feels like a lot to handle, don’t worry; Forecastia is the only AI-powered financial forecasting tool you need to make the process simple and stress-free.

It’s specifically designed for businesses looking to build accurate financial projections, anticipate future cash flows, and analyze overall financial performance—all without using spreadsheets!

Frequently Asked Questions

What are the key financial statements in a restaurant financial plan?

A detailed financial plan for a restaurant must include the following key financial statements:

- Income statement (Profit and loss statement)

- Balance sheet

- Cash flow statement

- Break-even analysis

What are common operating expenses in a restaurant financial plan?

The most common operating expenses to include in a restaurant financial plan are rent or lease, utilities, wages and salaries, food and beverage costs, marketing or promotions, as well as other miscellaneous supplies.

How do I create financial projections for my restaurant?

Follow these steps to create financial projections for your restaurant:

- Gather all the important information needed for financial planning—like your expected sales, ingredient costs, and operating expenses.

- Estimate how much revenue you’re going to make and how much you’ll spend each month.

- Create basic financial documents like a profit and loss statement, cash flow report, balance sheet, and break-even analysis.

- Then, test assumptions with what-if or scenario analysis for accuracy.

How often should I update my restaurant’s financial projections?

It's recommended to review and update your restaurant financial plan at least once a year. This will ensure your initial goals and projections remain accurate and aligned with your business’s growth.

How to use the restaurant financial projections template?

Enter your restaurant’s details, like your projected sales, COGS, and ongoing expenses into the restaurant financial plan template. It’s often designed with built-in formulas that help you calculate important metrics, such as gross profit, cash flow, and break-even point, providing a clear snapshot of your restaurant’s financial health.