Your financial future depends on one thing: the right financial forecasting technique. Startups, big or small, often lean on financial models to make decisions.

However, not all traditional financial modeling techniques are created equal. Many still use traditional methods, which are slow, involve tedious data handling, and often result in errors that affect strategic decision-making.

Sound familiar?

But thanks to advancements in AI financial modeling, businesses can now enjoy more accurate predictions and efficient data analysis, opening doors to smarter, faster growth. For startups and finance professionals, this means reduced effort, better risk assessment, and smarter financial planning for the future.

In this blog, we’ll discuss why AI in financial modeling is a paradigm shifter, how to use AI tools effectively, which tools can help, and more.

AI in financial modeling & forecasting: the trend

While traditional financial modeling techniques have served their purpose, the times are changing.

Here’s why they need to rethink them:

❓ Data quality and availability: Traditional forecasting often relies on historical data that may be incomplete, outdated, or inaccurate, leading to unreliable predictive analytics.

❓ Model complexity and scalability: Financial forecast methods like ARIMA or linear regression struggle to handle large data sets and miss detailed market trends or patterns.

❓ Uncertainty and explainability: Many models provide single-point predictions without accounting for financial risks, variability, or risk assessment.

The future of forecasting has arrived, and here are ways AI integration can simplify financial modeling.

✅ Fast and efficient financial insights: AI automates data collection, delivering real-time insights and allowing businesses to focus on strategic decision-making without getting bogged down by manual data handling.

✅ Sharper accuracy with fewer mistakes: By leveraging machine learning models and natural language processing, AI delivers accurate forecasts based on comprehensive data, reducing human error.

✅ Confident decisions in unpredictable markets: AI identifies market sentiment and analyzes key performance indicators to help businesses act decisively, even in volatile conditions.

✅ Tailored solutions for unique needs: AI provides customized solutions, including personalized investment advice and adaptable financial models, designed to meet specific business goals

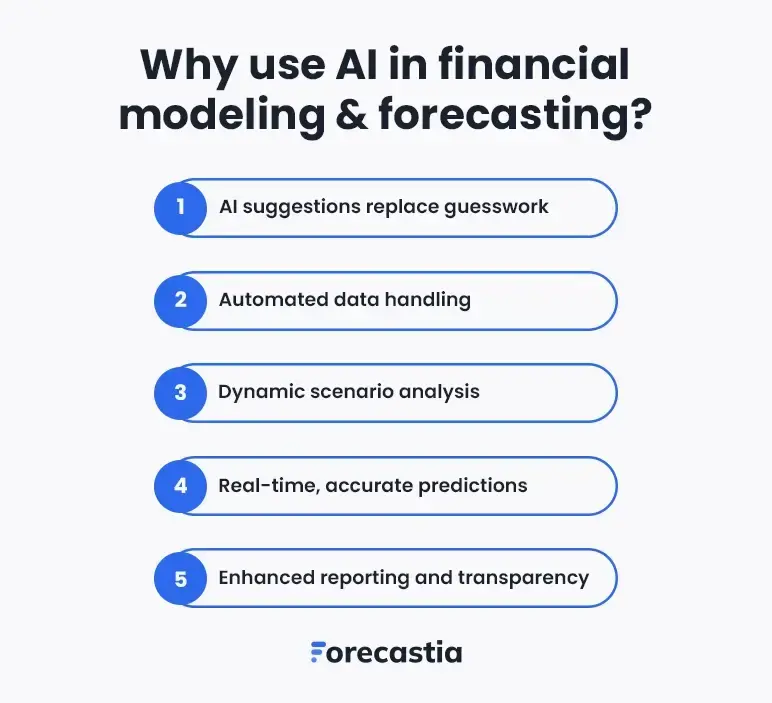

Why use AI in financial modeling & forecasting?

Tedious tasks are a thing of the past at JPMorgan Chase. Their AI models automate financial data processing, reducing prep time by 90%. This leap in AI financial modeling gives analysts more time to refine investment strategies and achieve stronger future financial performance.

Here’s why more businesses are jumping on the AI bandwagon for financial modeling and forecasting.

1. AI suggestions replace guesswork

Traditional models depend on subjective human judgment, leading to potential bias. By leveraging historical data and analyzing market trends, AI generates data-driven suggestions that offer correct predictions and help mitigate financial risks.

2. Automated data handling

Why spend hours on data handling manually when AI tools can process and clean financial data faster and more accurately? Automating the collection of data ensures operational efficiency, minimizes data errors, and enhances data quality.

3. Dynamic scenario analysis

Why limit your planning to a few outcomes? With AI-powered financial modeling, businesses can explore multiple scenarios and analyze complex interactions to provide actionable insights.

4. Real-time, accurate predictions

AI replaces static forecasts with adaptive models that adjust to new data in real-time. By analyzing vast amounts of data, AI helps in predicting future financial performance and identifying market trends with accuracy and speed.

5. Enhanced reporting and transparency

Interactive dashboards powered by AI models combine KPIs, financial metrics, and real-time insights, making financial reporting more transparent and empowering finance professionals.

AI has the potential to revolutionize financial modeling, but its true value lies in how it’s applied. Let’s see how it is used.

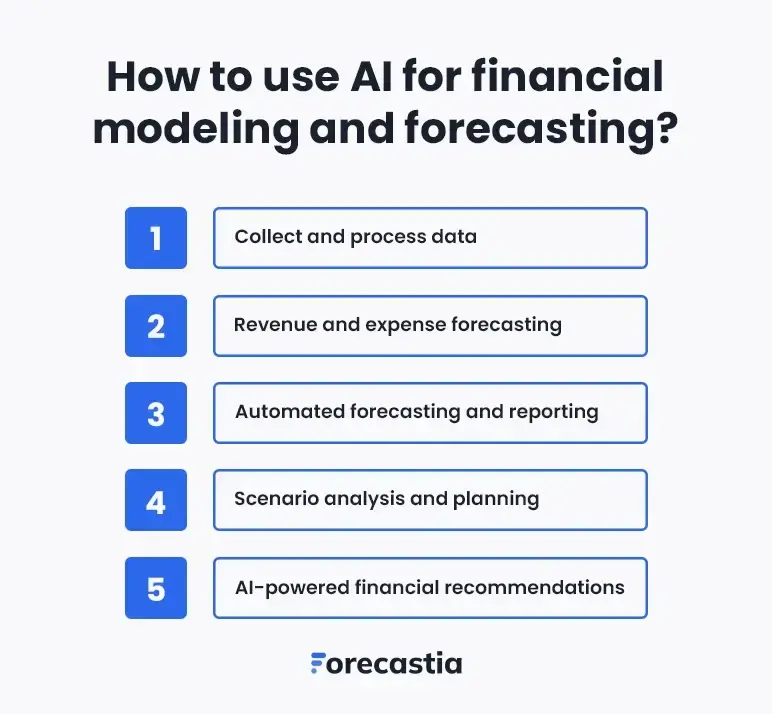

How to use AI for financial modeling and forecasting?

Financial forecasting has gotten a whole lot smarter thanks to AI-based tools like ChatGPT, Forecastia, and Upmetrics. For businesses aiming to get that competitive edge over others, these tools are all you’ll ever need to tap into real-time insights and predictive analytics for smarter and faster decisions.

Here’s how you can start leveraging AI:

1. Collect and process data

Data has been an integral part of the financial forecasting process, be it historical financial reports, tax return files, business invoices, or credit history. However, gathering and organizing these shedloads of data has always been a tedious job—even for experts.

Generative AI and the latest forecasting tools make this task a lot easier. You can use these tools to combine, organize, and analyze existing business data. Ask questions, automate manual calculations, and more.

2. Revenue and expense forecasting

It wasn't just complicated formulas, manual data entry, and tedious calculations entrepreneur's struggled with financial forecasting—guesswork was there too. Preparing accurate projections often required answering to questions like:

- How would my business make money?

- How would I charge my customers?

- Would only one major revenue stream suffice?

Which required some serious guesswork. AI forecasting tools like Forecastia provide revenue and expense stream recommendations, eliminating a significant step from the forecasting process.

Additionally, AI assistance can help you gain deeper insights into the suggested streams, which will help you increase the credibility of your numbers.

3. Automated forecasting and reporting

Manual forecasting and reporting is a time sink. It is painfully slow, prone to errors, and downright exhausting. Let’s not forget the hours wasted on spreadsheets that still fail to provide actionable clarity.

AI analyzes all your data—past and present—instantly, delivering sales projections, budgets, and cash flow reports with accuracy you can trust. Better yet, interactive dashboards turn complex numbers into presentable visuals, allowing you to make business decisions with confidence and clarity.

4. Scenario analysis and planning

Scenario planning used to mean stress, spreadsheets, and a whole lot of “What now?” questions. Every “what if expenses rise?” or “what if revenue falls?” felt like starting from scratch, and there was never enough time to cover all possibilities.

Generative AI simplifies scenario analysis by:

- Brainstorm and plan multiple financial scenarios for your business

- Running simulations instantly to show how decisions impact your bottom line.

- Offering actionable insights by analyzing market trends and identifying risks or opportunities

Whether you’re preparing for best-case, worst-case, or something in between, AI ensures your decisions are based on data, not guesswork.

5. AI-powered financial recommendations

Financial planning is tough. Trying to stay on top of cash flow, figure out profitability, and manage expenses is tough enough without adding guesswork into the mix. You need to keep a track of “How many units will I sell next month?” or “How soon will I hit profitability?” Good luck doing it all manually.

If you are tired of cookie-cutter financial advice, AI-powered recommendations are all you need. It can answer critical questions like:

- When will I hit profitability?

- What are my February 2025 sales projections?

- How much funding do I need by December 2025?

AI gives you instant access to everything you need, whether it’s understanding profitability, analyzing cash flow, or managing expenses.

The way we approach forecasting is evolving, and AI-powered tools offer clarity and precision. So, businesses looking to stay competitive need to start leveraging AI now.

If you’re serious about getting ahead, it’s time to look at these tools, figure out what works for you, and get to work.

AI tools to watch out for financial planning

With the rise of AI for financial modeling, businesses are rethinking how they approach forecasting and analysis. To win, many organizations are turning to AI-based tools that simplify processes, enhance accuracy, and deliver actionable insights.

Here are some of the best tools on their hot list.

1. ChatGPT

Debuting in late 2022, ChatGPT became an instant success everywhere, including the financial sector. Powered by large language models, it handles a wide range of applications, from generating ideas to delivering accurate forecasts and assisting in risk management. Its automation capabilities free up time for financial analysts, allowing them to focus on strategic goals.

Professionals on Capterra praise ChatGPT for its efficiency and reliability. Finance teams value its adaptability, intuitive design, and the additional capabilities provided by plugins, all supported by exceptional customer service.

2. Forecastia

For businesses seeking simplicity in financial forecasting, Forecastia is the best financial forecasting software. It eliminates the outdated practice of juggling spreadsheets, manual data entry, and error-prone calculations.

Forecastia’s intuitive features allow you to analyze transaction data, predict trends, and maintain control over your cash flow and budgets. With a focus on usability and accuracy, it’s a tool designed to streamline finance-related processes and empower strategic planning.

3. Upmetrics

Upmetrics is a versatile business planning platform that simplifies the complex financial forecasting and planning process. Designed for businesses of all sizes, it empowers users to develop detailed financial models, create business plans, and visualize their growth potential with ease.

With its user-friendly interface, Upmetrics eliminates the need for manual data handling, enabling businesses to focus on strategy rather than spreadsheets. From generating accurate forecasts to tracking key performance metrics, Upmetrics is the tool to elevate your planning process.

How secure is AI financial modeling and forecasting?

AI can power up your financial forecasting, but let’s not hand over sensitive data to just any platform. Choose platforms with reliable encryption and strict access controls to protect your data. Without these, you’re setting yourself up for unexpected surprises. And in finance, “surprises” usually mean something went terribly wrong.

Here is a checklist you can follow while selecting AI models:

- Use AI models with advanced encryption methods to protect data.

- Select tools with risk mitigation strategies that detect and prevent vulnerabilities.

- Opt for large language models that analyze data securely while maintaining precision.

- Conduct compliance checks regularly to align with regulations and avoid legal risks.

- Train finance teams to handle AI responsibly and follow secure data-handling practices.

Trusted tools like Forecastia and Upmetrics strongly emphasize security, incorporating advanced technologies to protect sensitive financial data. For instance, these platforms use robust encryption standards to secure data both during transmission and while stored in their systems.

So, any information the finance teams share with these tools is encrypted, making it nearly impossible for unauthorized users to access or decipher it.

The security of implementing AI for financial forecasting and modeling is not a one-size-fits-all scenario. It heavily relies on the specific tools chosen for the task.

The future of AI in financial modeling & forecasting

The future of finance with AI looks bright, as businesses increasingly rely on advanced tools to improve their decision-making. With the ability of vast data analysis, AI-based tools are redefining how financial professionals approach forecasting, moving beyond traditional methods that often rely heavily on static past data.

AI financial models use machine learning algorithms to identify patterns and trends within dynamic datasets. That lets businesses generate real-time insights and respond swiftly to market fluctuations.

One of the biggest advantages of AI models is its accuracy. Unlike manual models, AI systems continuously learn and adapt based on new information. In today’s volatile markets, that is something we all are rooting for.

Faster financial insights are just an AI tool away!

With the advent of AI, financial forecasting has changed 180 degrees. It analyzes massive datasets, delivers real-time insights, and keeps everything compliant with regulations. With AI, businesses achieve more accurate forecasts, smarter decisions, and better risk management.

But this is just the start. Machine learning and predictive analytics keep evolving. Every new step in this technology makes forecasting faster, sharper, and more reliable. The future of financial forecasting is already here, waiting for those ready to use it. If you are one of them, Forecastia is the ultimate AI solution you need for crunching those financial numbers.

Frequently Asked Questions

Can ChatGPT-4 do financial modeling?

Yes, OpenAI's GPT-4 can analyze financial statements and forecast future earnings growth with remarkable accuracy, potentially exceeding human analysts' performance.

Can AI make a financial model?

Yes, AI can make a financial model for businesses to project key metrics such as revenues, expenses, cash flows, and others that are critical for proper monitoring and planning.

How to use AI for financial projections?

In the financial sector, AI financial models drive insights across various functions, including data analytics, performance measurement, predictive modeling, real-time computations, customer support, and efficient data retrieval.

How is AI different from traditional financial forecasting?

AI financial models differ from traditional technology in that they are specifically designed to imitate human intelligence and learn from data inputs, empowering them to undertake tasks that typically rely on human cognitive abilities. This field includes subdisciplines, such as machine learning, natural language processing, computer vision, and robotics.

Do I need a finance background to use AI for financial modeling?

While a finance background can be beneficial, it’s not strictly necessary when using AI financial modeling. AI tools are increasingly designed to be user-friendly and accessible, allowing individuals without extensive financial training to leverage their capabilities effectively.

Can AI help startups with financial planning?

Yes, AI financial modeling can help startups by automating financial processes through applications that enhance efficiency and accuracy. Here are some ways in which AI achieves this:

- Automated data entry and bookkeeping

- Streamlined reporting

- Expense tracking and management

- Regulatory compliance automation.

- Enhanced cash flow management

- Fraud detection

- Improved customer service