Sales forecasting isn’t just for big corporations—it’s essential for every business. Your revenue, cash flow, and growth depend on predictable sales.

Without a forecast, you’re constantly reacting to problems instead of preparing for them.

Some days, overstocking ties up your cash, and other days, running out of stock drives customers away. The worst part? You won’t see it coming until it’s too late.

But forecasting isn’t complicated—especially if you’re just starting out. With the right approach, you can build a simple, accurate sales forecast that keeps your business on track.

Let’s understand how to forecast sales in this step-by-step guide.

What is sales forecasting?

Sales forecasting is the process of estimating future sales performance based on historical data, industrial benchmarks, and economic trends.

Most businesses tend to develop forecasts for next week, month, quarter, or fiscal year. Yet some businesses develop projections for up to 36 months to guide their long-term strategy.

More than numbers, forecasts serve as a strategic tool. They offer actionable insights to help with planning (how many units to produce), resource allocation (whether to expand production), and decision-making (if it’s the right time to enter a new market).

How to create a sales forecast?

Let’s now understand the process of creating a sales forecast for your business plan.

1. Document your sales process

Start with a clearly defined sales process that outlines how leads move through your funnel—from initial contact to closing the deal.

Break it down into structured stages and determine key metrics that will help track performance and build accurate forecasts.

| Sales Process | Key metrics | Example |

|---|---|---|

| Lead generation | Number of leads, cost per lead | 1000 website visitors |

| Qualification | Conversion rate, lead quality score | 100 leads → 20 qualified leads (20%) |

| Proposal | Proposal acceptance rate | 20 qualified leads → 10 proposals or demo signups |

| Closing | Conversion rate, average deal size | 10 proposals → 3 closed deals (30%) |

| Post-sale | Customer retention rate, lifetime value (LTV) | 3 closed deals → 2 repeat customers |

Before you move ahead, make sure that you have established definitions for key terms and have defined clear criteria for moving deals between stages.

A well-documented sales process will provide a reliable foundation for your forecasting assumptions. It will help:

- Predict future sales more accurately by understanding conversion rates at each stage

- Identify weak points in your funnel where leads drop off and adjust strategies accordingly

- Set realistic revenue targets based on actual sales flow instead of assumptions

2. Gather historical data (if available)

Now businesses that have been operating for long or at least a couple of years, can gather historical data to chart projections for the future.

The more accurate and relevant your data, the more reliable your forecast will be.

Here are a few key sales data you should have:

- Total sales revenue

- Units sold for a given period

- Average sales price

- Highest-selling and revenue-generating products/services

- Sales by channel (online, retail, direct)

- Conversion rates, percentage of lead conversions

- Return rates, if applicable

- Customer retention rates

Gather at least 12-24 months of data so that you can identify patterns, peak seasons, consumer changes, and much more in detailed insights. However, you must focus on qualitative data rather than long-term data.

3. Choose a forecasting approach

Startups with no historical data will rely on one of these sales forecasting methods to build their sales assumptions:

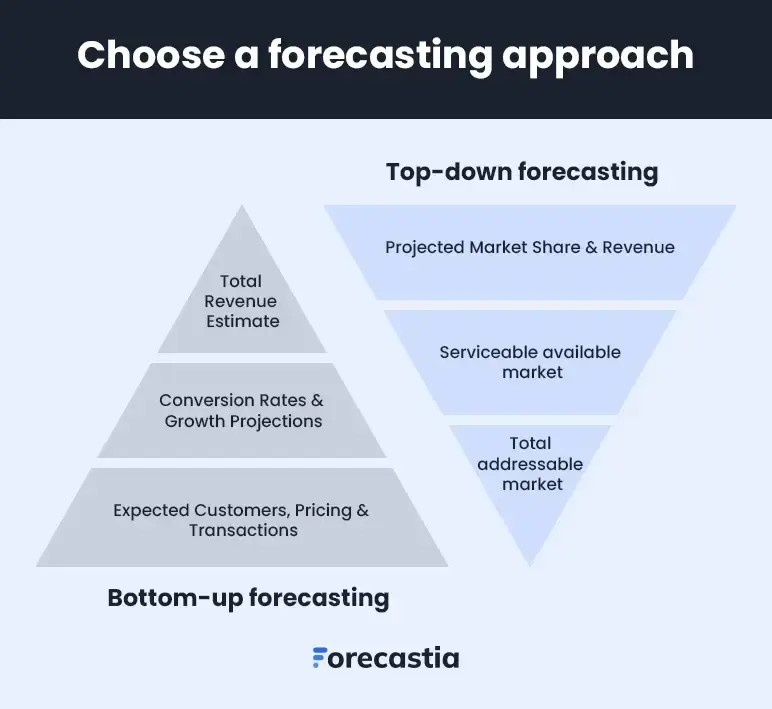

Top-down forecasting

This method starts with the total addressable market (TAM) and works downward to estimate potential revenue. It’s useful when industry-wide data is available, but internal sales figures are limited.

For instance:

A skincare brand ‘Vyasa’ looking to forecast revenue might start by assessing the global skincare industry, which let’s say is valued at $150 billion. Within their target market, the serviceable market is estimated at $1 billion. As per their projection, if they capture just 0.5% of that market, their projected annual revenue would be $5 million.

While this calculation may seem pretty convincing on the surface, it isn’t backed by data-driven assumptions.

The result? You end up with overestimated projections that don’t reflect business reality.

Bottom-up forecasting

This approach starts with individual sales drivers—like expected customers, transaction volume, or unit sales—and builds up to a revenue projection based on pricing and growth assumptions.

Let’s take the example of the same skincare company. However, this time we project revenue using a bottom-up approach.

After estimating customer acquisition efforts, Vyasa predicts selling 25,000 units of moisturizers in the first year. With an average price of $9 per unit, their projected monthly revenue stands at $18,750 or $225,000 annually.

That said, bottom-up forecasting is grounded in execution. It relies on real sales drivers rather than broad market assumptions, making it more practical for startups.

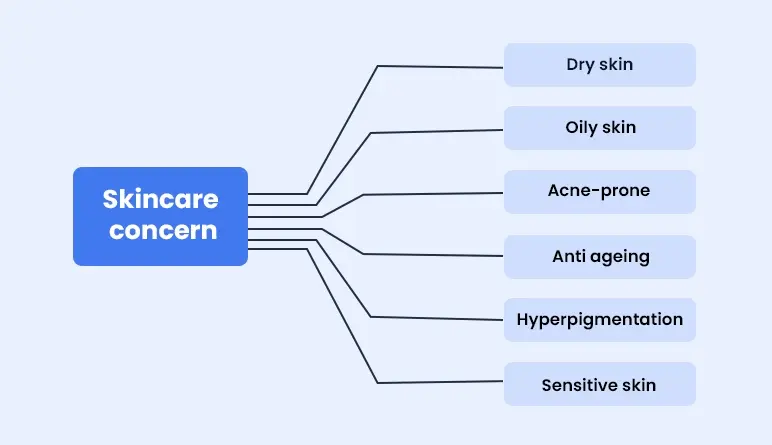

4. Categorize your product and services

Now, list down all your products and services and group them into logical categories. Not too broad that insights are lost, but not too detailed that it becomes overwhelming to track.

Ideally, your categories should closely resemble your accounting structure. This way, it’s easier to track the actuals with your forecasts.

Continuing the Vyasa (skincare brand) example, the brand would categorize their products like:

- Product ranges: acne range, dry skin range, barrier repair range

- Product types: sunscreens, moisturizers, retinol, face scrubs, clay masks

- Product sizes: mini, standard, large

Graphic suggestion:

These categorizations would help you understand what product lines drive the most revenue, where sales are declining, and how customer demand varies across different segments.

5. Estimate your sales

Estimate what you expect to sell in the next month, quarter, or year.

Think in terms of clear measurable units, i.e. billable hours, consultancy projections, number of subscriptions sold, and number of orders fulfilled.

And while you can rely on past data to build your estimates, you must also consider market conditions, seasonal trends, and consumer behavior.

For example, Vyasa Skincare sold 20,000 moisturizers consistently over the last two quarters. However, with winter approaching, they expect a 20% increase in demand, forecasting 24,000 units for the next quarter. Factoring in these real-world changes makes forecasting far more accurate.

Now, not all businesses forecast sales in units. Many SaaS and service-based companies make the mistake of jumping straight to revenue forecasts, saying something like:

"We want to achieve $250,000 MRR in Q1."

While ambitious, this assumption lacks clarity on how that revenue will be achieved. Revenue projections alone don’t reveal whether growth comes from more customers, higher pricing, or improved retention.

A better approach is to start with unit-based forecasting.

For example, instead of setting a revenue target, a SaaS company could predict acquiring 5,000 new subscriptions at $50 per month. This method provides a structured and actionable roadmap for achieving revenue goals.

6. Determine your costs and price per unit

After estimating how much you plan to sell, the next step is determining your per-unit cost and setting your price.

Your cost per unit is the foundation of your pricing. It includes:

- Cost of goods sold (COGS): The direct costs involved in producing or delivering your product or service

- Variable costs: Expenses that change with sales volume, such as shipping fees, transaction fees, and sales commissions

After calculating the cost to produce one unit, determine the price you want to set. Consider brand positioning, customer expectations, and competitors' pricing while leaving reasonable room for your margins.

Continuing the same skincare brand example, here’s a simplified version of how their product pricing and revenue projection might look.

| Product | Cost per unit | Price per unit | Estimated sales | Total COGS (cost per unit* estimated sales) |

Total sales (price* units) |

|---|---|---|---|---|---|

| 15-50 | $4 | $9 | 12000 | $48,000 | $108,000 |

| 15-50 | $6 | $12 | 8000 | $48,000 | $96000 |

| 15-50 | $2 | $6 | 9500 | $19,000 | $57000 |

| Total | 29,500 | $115,000 | $261,000 | ||

7. Determine your gross profit

As a last and final step, determine the gross profit, i.e. how much your business actually keeps after covering the direct costs of production.

Gross profit= Total Revenue – Total COGS

Using the skincare brand example, we get their gross profit to be $146,000 ($261,000-$115,000).

These figures help evaluate whether the pricing and cost structure are sustainable and offer healthy reliable margins. They indicate how efficiently a business generates revenue before covering operating expenses like marketing, rent, and salaries.

And that’s how you build a viable sales forecast—step by step, from defining your sales process to calculating profitability.

How to make assumptions for your sales forecast

Sales forecasting is all about making informed assumptions about the future. While past data provides a baseline, it isn’t enough. To build accurate projections, you must factor in both external market conditions and internal business factors that directly impact sales.

Here are the key factors that should be considered to create reliable assumptions about sales:

Market condition

Evaluate the current and future market conditions to understand their macro influence on your business growth.

You can do that by analyzing relevant industrial reports from Gartner, MarketResearch, and Statista. You can also refer to publications and studies published in your specific niche.

Here are a few insights you should gather from such reports:

- Is your overall market growing or shrinking?

- Are new businesses entering the market, or are existing ones exiting?

- Is the demand for your product or service category expected to increase?

- Are there upcoming innovations or technological advancements that could make existing solutions redundant?

Realistically, progressive markets will help you capture a larger market share while the shrinking market may restrict your sales.

Regulatory changes

- Are there policy changes that could limit or expand market access in certain regions?

- Is there a risk of stricter advertising or data protection laws that could impact lead generation and customer acquisition?

- How regulated is your industry and how frequently do compliance requirements change?

These questions are especially important for businesses operating in highly regulated industries, such as fintech, where regulatory shifts can significantly impact growth and revenue projections.

Seasonality

Every business goes through seasonal shifts, but the timing and impact vary. Some have clear peak seasons, while others see smaller fluctuations within months, weeks, or even days.

Recognizing these patterns is key to making accurate short-term sales projections and avoiding stock or cash flow issues.

Check the CRM data and ask these questions to get a realistic understanding:

- Does your industry experience predictable seasonal trends that impact sales volume?

- Are there specific months, quarters, or events where demand spikes or slows down?

- Has the sales fluctuated significantly during weekends or certain hours?

Economic and consumer behavior trends

Sometimes, a drop in sales has nothing to do with your product or its pricing. It could be due to inflation, unemployment, or simply changing consumer preferences. It’s important to consider these changes and their impact on your future sales.

Operational and supply chain factors

A sales forecast is only realistic if your business can meet demand. Even when demand is high, supply chain issues, staffing shortages, or production limits can hold back sales.

Ask these key questions as you build assumptions:

- Can your current production or service capacity support the forecasted sales growth?

- Are there supply chain risks that could impact inventory or delivery timelines?

- Does your workforce have the resources and staffing needed to handle increased demand?

- How quickly can you scale up operations if demand exceeds expectations?

Marketing and sales strategies

Whether you plan to launch new campaigns or expand your current marketing efforts, you will see a direct or indirect impact on your sales. The idea is to forecast how much volume these campaigns will bring to dictate your operational and sales efforts.

Questions worth asking at this stage are:

- Will you be making changes to the product or pricing?

- Will you be launching a new marketing campaign?

- How will the sales react to seasonal promotional campaigns?

- Are you planning to capture a new audience?

- Will you be targeting a new marketing channel?

- Will there be budget cuts on marketing?

Competitive landscape

Keep an eye on the evolving competitive landscape to determine how it will affect your sales. New competitors, pricing shifts, or aggressive marketing from rivals can affect demand and customer retention.

Ask these key questions as you figure out what values should you assume for sales:

- Are customers more likely to switch your brand with a competitor?

- Have competitors changed their pricing, promotions, or product offerings in a way that could impact your sales?

Those are most, if not all the factors that would influence your assumptions about sales, to varying degrees.

Determine what factors factor in the most for your business and use your expertise to build relevant assumptions, while keeping room for adverse scenarios.

Common sales forecasting mistakes to avoid

Forecasts are nothing but assumptions and even the most seasoned professionals can miscalculate projections. Well, nothing guarantees absolute certainty, but avoiding these common financial forecasting mistakes can help improve accuracy and decision-making.

Ignoring seasonality: Summer, fall, and winter aren’t the only seasons affecting your business. Look for holiday spikes, shopping behavior shifts, and even weekday vs. weekend variations that impact sales cycles

Over-reliance on past data: Relying extensively on past data while completely ignoring market trends, competition, and economic shifts will definitely lead to inaccurate forecasts

Not involving your sales team: Excluding them from the forecasting process means missing out on valuable insights about customer behavior, buying patterns, and potential roadblocks that data alone won’t reveal

Failing to adjust forecasts regularly: Market conditions change, and so should your sales forecast. Sticking to outdated projections without reviewing actual performance can lead to poor decision-making

Ignoring internal operational constraints: Even if demand is high, supply chain issues, staffing shortages, or production limits can prevent businesses from meeting their forecasted sales

Overcomplicating the forecasting process: Using too many variables or complex models without a clear structure can make forecasts harder to understand and act upon

Communicating forecasts to stakeholders

If you thought building sheets of sales forecasts was enough, it’s not. Sales forecasts—like any financial data—need to be communicated effectively to drive action and decision-making.

Stakeholders need more than just numbers; they need insights. Instead of overwhelming them with raw data, present forecasts using clear takeaways, trends, and visual summaries that highlight what matters.

Visuals make the data much easier to grasp and contextualize. Besides, when presenting, make sure that you explain the assumptions behind the numbers and clarify the risks involved. And, for internal teams, break forecasts into realistic sales targets that align with their roles.

Remember, a forecast is only as good as how well it’s understood—keep it clear, relevant, and updated as market conditions evolve.

Prepare your sales forecast with Forecastia

That said, sales forecasts are the backbone of your business plan. Investors and stakeholders would gauge the business’s worth and its growth with your sales projections.

In fact, your forecasts directly shape your company’s financial strategy, influencing budgeting, cash flow planning, and overall business decisions.

Now, building a sales forecast may seem intimidating. In fact, it’s, if you’re still relying on Excel and spreadsheets.

But with Forecastia—an AI financial forecasting tool, the process of developing projections becomes extremely easy. The tool integrates data from your accounting systems in real-time, offers AI suggestions, and automates calculations without requiring you to work on a single formula. All without getting overwhelming for the new planners.

Stop waiting. Sign in today and build your forecasts for the future.

Frequently Asked Questions

Why is sales forecasting important?

Sales forecasting helps businesses predict revenue, manage resources, and make informed decisions about other business avenues. Forecasting sales helps with:

- Better financial planning: Helps businesses budget, allocate resources, and manage cash flow effectively

- Improved inventory management: Prevents stock shortages or overstocking by predicting demand

- Stronger decision-making: Guides hiring, marketing, and expansion strategies with data-backed insights

- Investor and stakeholder confidence: Accurate forecasts show business potential and financial stability

- Identifies risks early: Helps businesses adjust strategies when sales trends indicate potential challenges

How to improve sales forecasting accuracy

To improve the accuracy of your sales forecasts:

- Use historical sales data and adjust for market trends

- Factor in seasonality, economic shifts, and competitor activity

- Involve sales and marketing teams for on-the-ground insights

- Choose the right forecasting model

- Regularly review and update forecasts based on actual performance

How do you forecast sales for a new product?

To forecast sales for a new product, start by analyzing competitor benchmarks and market demand. Conduct customer interviews or run beta tests to gauge interest. Track early conversions from ads or pre-orders and adjust projections based on real-time data.